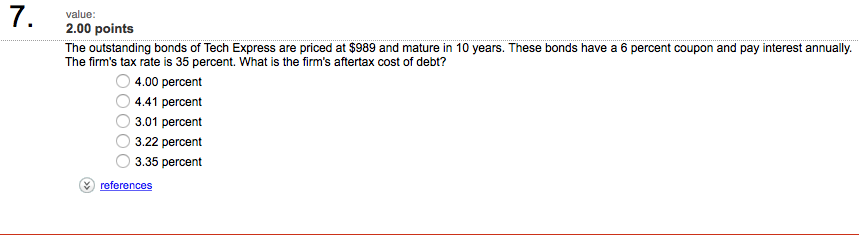

In today’s dynamic financial landscape, understanding the intricacies of bond pricing is crucial for investors seeking to maximize returns while managing risk. One such entity that has captured the attention of the market is Tech Mytechme.com/ Express, a leading technology company known for its innovative products and services. Let’s delve into the outstanding bonds of Tech Express, which are currently priced at $989 and mature in 10 years.

Introduction

Understanding Bond Pricing

Before delving into the specifics of Tech Express bonds, it’s essential to grasp the fundamentals of bond pricing. Bonds are debt securities issued by corporations or governments to raise capital. The price of a bond is influenced by various factors, including interest rates, market conditions, and the issuer’s creditworthiness.

Exploring Tech Express Bonds

Background of Tech Express

Tech Express has established itself as a pioneer in the tech industry, known for its cutting-edge solutions and strong market presence. As part of its financing strategy, the company issued bonds to investors, offering them a fixed return over a specified period.

Pricing of Tech Express Bonds

The current price of Tech Express bonds stands at $989, reflecting the market’s perception of the company’s financial health and future prospects. This price indicates a discount to the face value of the bonds, presenting an opportunity for investors to acquire them at a lower cost.

Analyzing the Market Factors

Market Conditions

The pricing of Tech Express bonds is influenced by prevailing market conditions, including supply and demand dynamics, investor sentiment, and economic indicators. A favorable market environment can drive up bond prices, while adverse conditions may lead to markdowns.

Interest Rates Influence

Interest rates play a significant role in bond pricing, with inverse relationships between bond prices and interest rates. When interest rates rise, bond prices tend to fall, and vice versa. Investors must monitor interest rate movements to assess the impact on bond valuations.

Impact of Maturity

Long-term Prospects

With a maturity period of 10 years, Tech Express bonds offer investors a long-term investment opportunity. The extended maturity period provides stability and predictability, making them attractive for risk-averse investors seeking steady returns.

Short-term Considerations

Despite their long-term benefits, Tech Express bonds also face short-term considerations, such as market volatility and liquidity concerns. Investors should weigh these factors carefully before making investment decisions.

Evaluating Risk and Return

Risk Factors

Like all investments, Tech Express bonds carry inherent risks, including credit risk, interest rate risk, and market risk. Investors must conduct thorough risk assessments to gauge the likelihood of potential losses.

Return on Investment

The return on investment for Tech Express bonds comprises both interest income and potential capital gains or losses. By analyzing the expected returns relative to the associated risks, investors can determine the attractiveness of investing in these bonds.

Comparing with Competitors

Benchmarking Against Industry Standards

To assess the performance of Tech Express bonds, investors often compare them with similar bonds issued by competitors in the technology sector. Benchmarking allows for a comprehensive evaluation of relative strengths and weaknesses.

Competitive Advantage Assessment

Tech Express’s competitive advantage, including its market position, financial stability, and growth prospects, influences the pricing and performance of its bonds. Investors should consider these factors when comparing Tech Express bonds with those of its peers.

Investor Strategies

Holding vs. Selling

Investors have the option to either hold onto their Tech Express bonds until maturity or sell them in the secondary market. The decision depends on individual investment objectives, risk tolerance, and market conditions.

Diversification Approaches

Diversification is key to managing investment risk effectively. Investors can mitigate risk by diversifying their bond portfolio across different issuers, industries, and maturities, reducing their exposure to specific market fluctuations.

Future Outlook

Tech Express Growth Projections

Looking ahead, Tech Express is poised for continued growth, driven by its innovation pipeline and expansion initiatives. The company’s strong fundamentals position it favorably for future bond issuances and investor confidence.

Market Trends Forecast

Forecasting market trends is essential for anticipating shifts in bond prices and investor sentiment. By staying abreast of industry developments and economic indicators, investors can make informed decisions about their Tech Express bond holdings.

Conclusion

Summary of Tech Express Bond Evaluation

In conclusion, the outstanding bonds of Tech Express offer investors an opportunity to participate in the company’s growth story while enjoying fixed returns over the long term. By conducting thorough analysis and considering market factors, investors can make informed decisions about incorporating Tech Express bonds into their investment portfolios.